Hour Criterion

Your hour registration app.

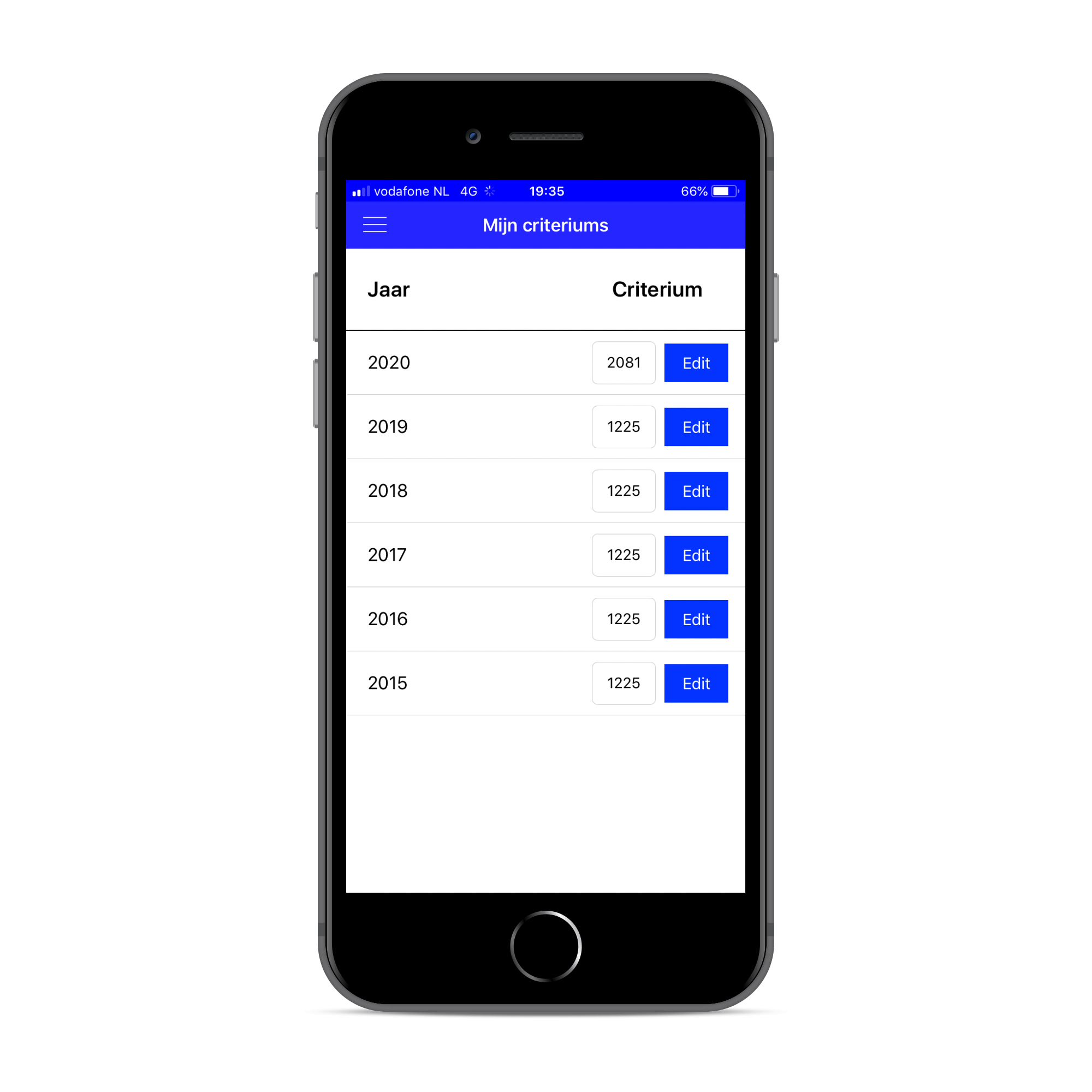

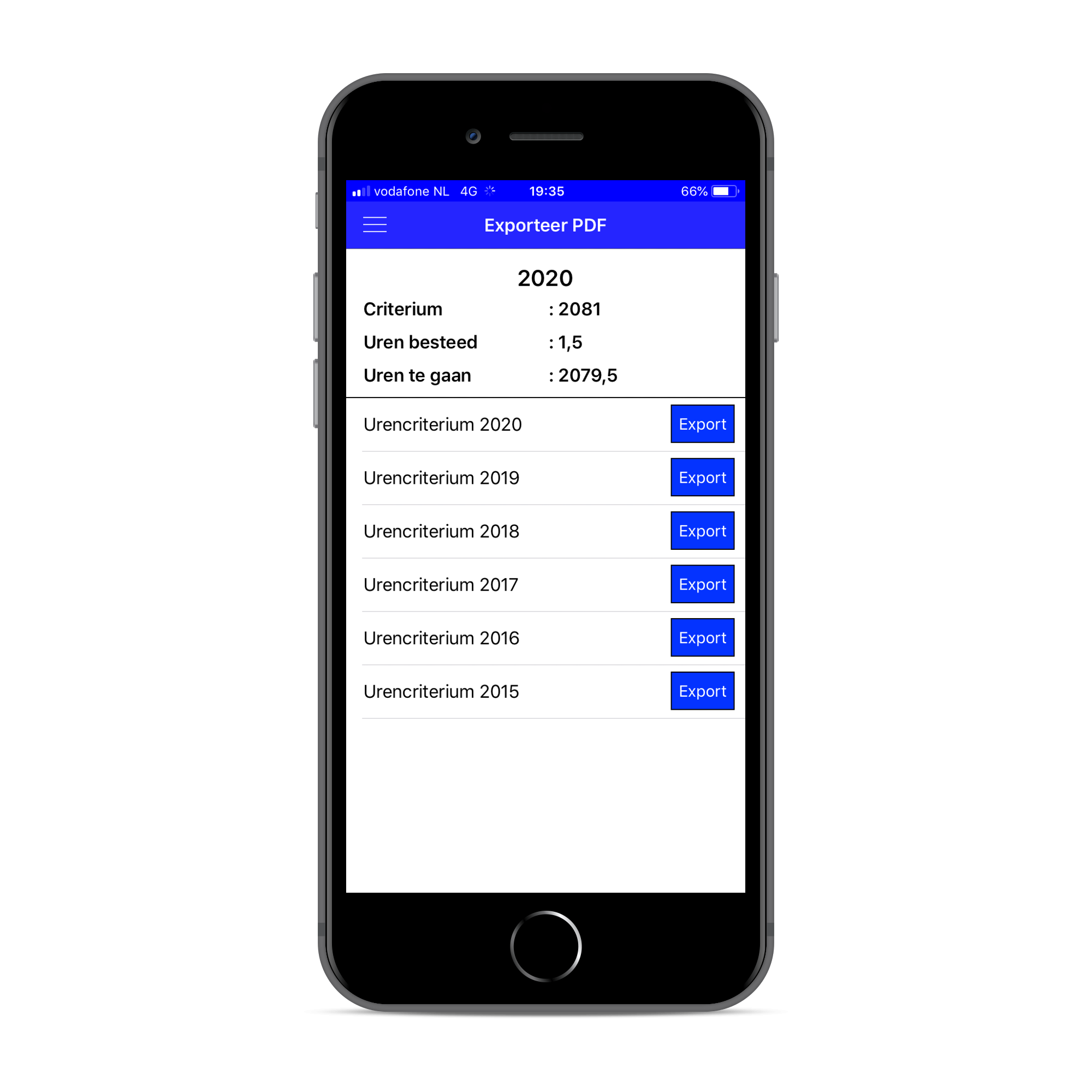

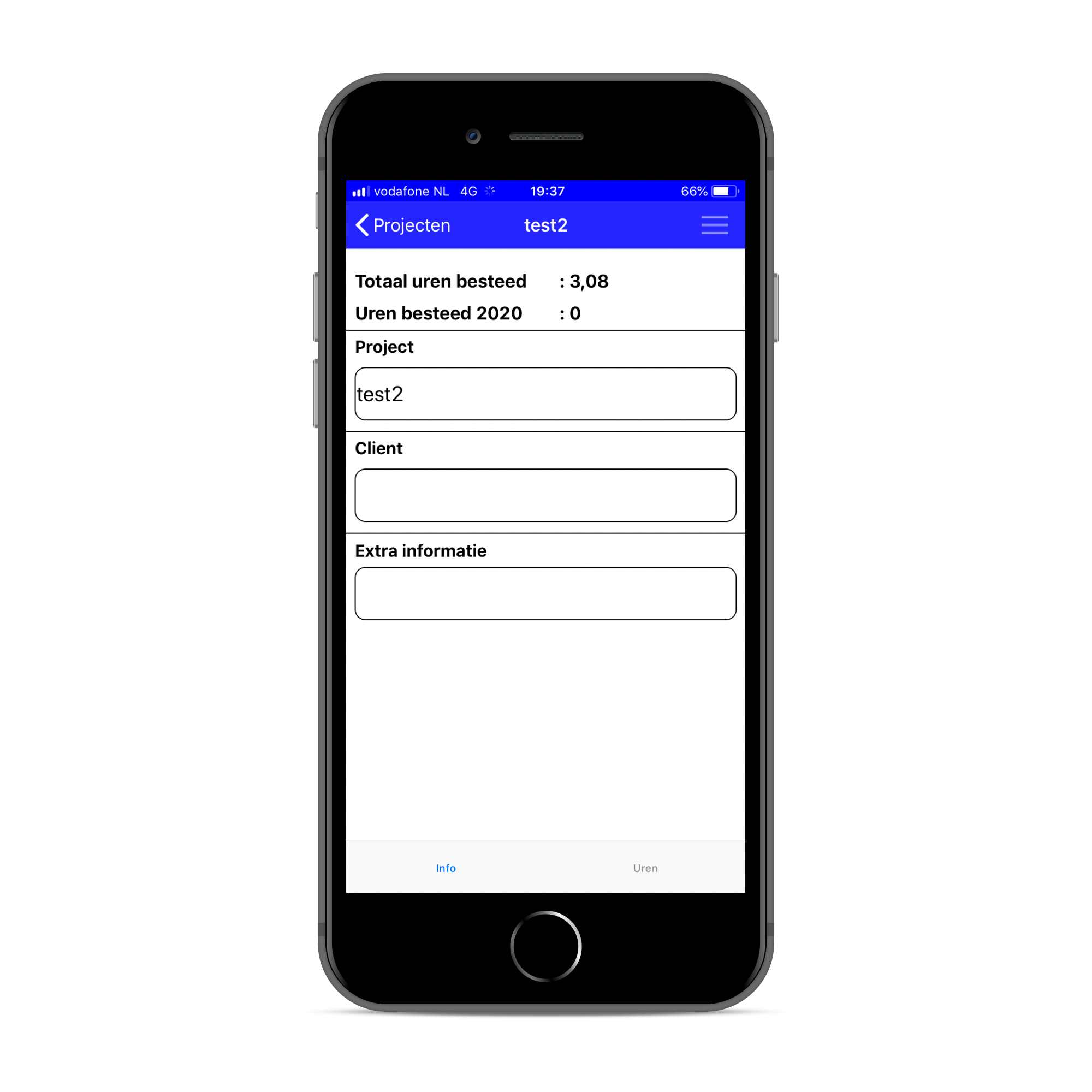

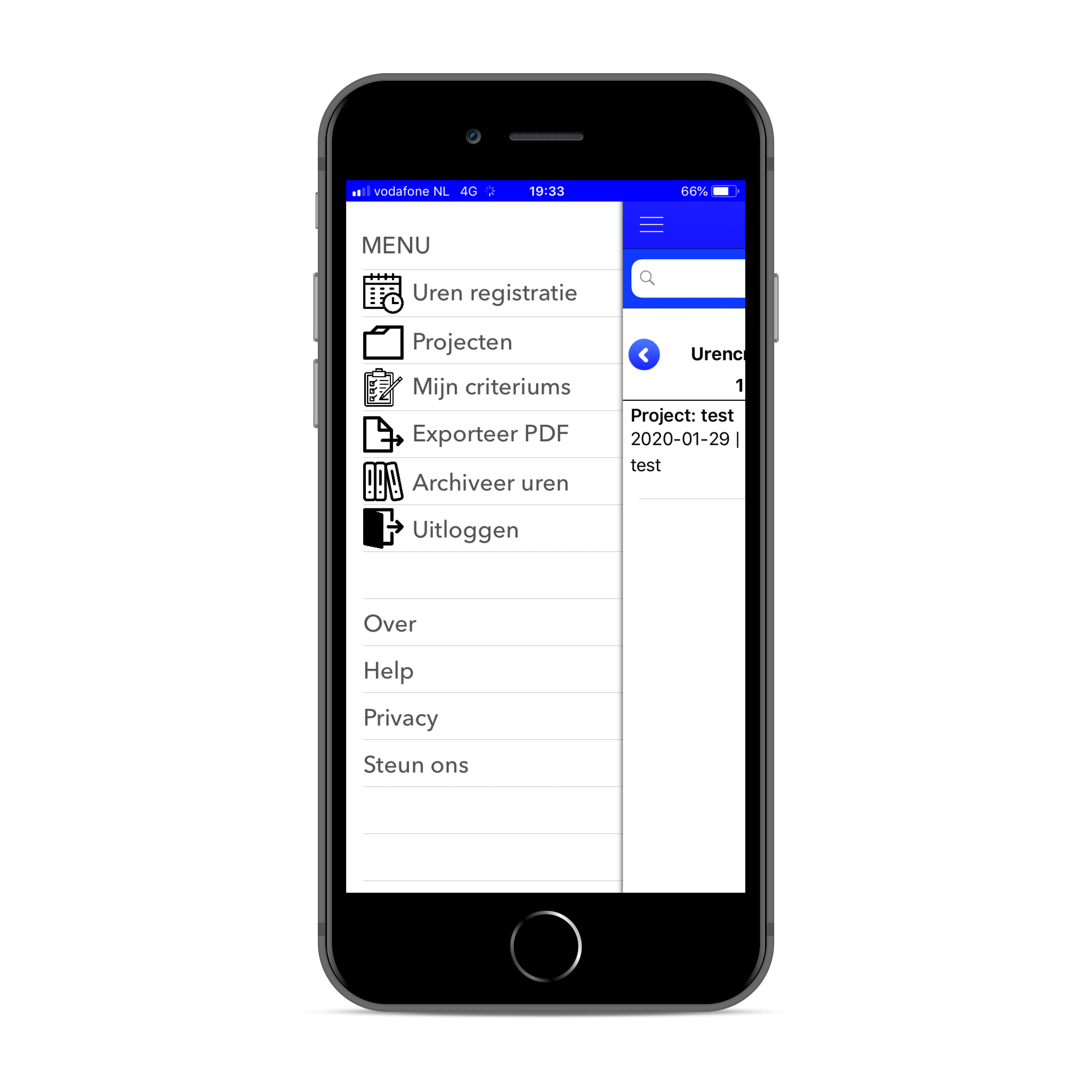

Hour criterion is an hour registration app that will help you prove that you have achieved the hour criterion. By registering your worked hours in the app, you have the option of generating an overview of the hours in PDF format that you can use as a burden of proof at the tax authorities.

Why Hour Criterion

If you are seen as an entrepreneur by the income tax, you are entitled to a number of benefits if you meet the conditions. The most important benefit is the Entrepreneur's discount, which includes:

- self-employed deduction (amounts to a maximum of € 7280 in 2019).- Starters deduction(amounts to a maximum of € 2123 in 2019).

As a starter, your benefit can rise to € 9483 per year in the first 3 years if you make use of the starters' discount, which you can apply 3 times. And the following years your benefit can go up to € 7280. You meet the hour criterion on the basis of the following points:

- You spend 1,225 hours or more on your company in a calendar year. You must also meet this condition if you start or stop your company during the course of the year.

- You spend more time on your company than on other work. For example if you also work as an employee. Were you not an entrepreneur for 1 or more years in the last 5 years? Then this condition does not apply (after having had a business for 5 years you are therefore obliged to spend more hours in your own company than as an employee).